Introduction

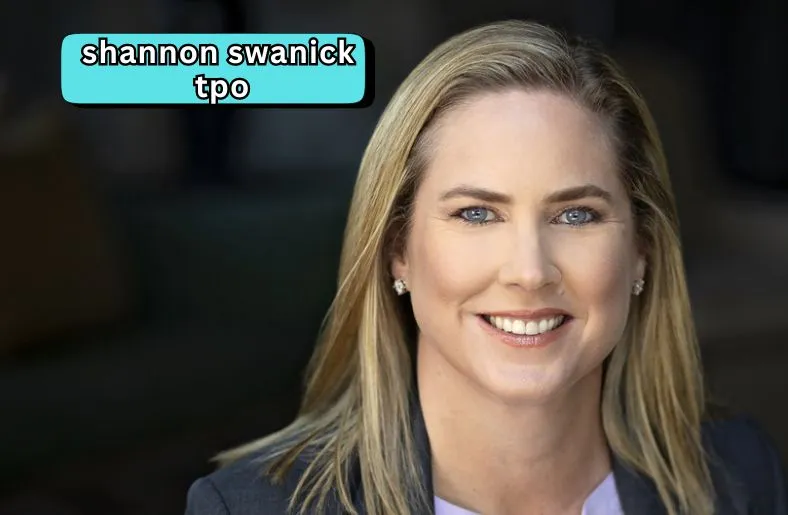

Shannon Swanick TPO is a leading figure in the world of finance. Known for her role in Third-Party Origination (TPO), she is making waves in how financial services are delivered. Her work focuses on improving the mortgage and loan processes, making them smoother and more efficient.

In this blog post, we’ll explore Shannon Swanick’s journey and her impact on the TPO industry. We’ll look at her early career, the innovative strategies she has introduced, and how these changes have improved customer experiences. Additionally, we’ll discuss the challenges she has faced and her future prospects.

Shannon Swanick’s contributions are not just about technology but also about enhancing personal service. Her approach is reshaping the financial landscape. Stay tuned to learn how Shannon Swanick TPO is leading the way in transforming finance.

Early Career and Background

Shannon Swanick TPO’s journey began with a strong educational foundation. She studied finance and business at well-known institutions. This solid background prepared her for a successful career in the financial sector. Starting out, Shannon held modest roles, where she quickly showed her talent. Her early jobs gave her deep insights into financial operations and customer needs.

As she gained experience, Shannon’s skills in managing financial processes became evident. Her dedication and innovative ideas set her apart from her peers. Shannon’s early career was marked by a commitment to learning and growing. This drive helped her to advance in the competitive world of finance.

Transitioning into the TPO sector, Shannon applied her knowledge to improve loan and mortgage processes. Her work focused on streamlining these procedures, making them more efficient. By solving complex problems and introducing new strategies, Shannon laid the groundwork for her future success. Her early career achievements paved the way for her prominent role in the financial industry today.

Rise to Prominence in TPO

Shannon Swanick’s rise to prominence in the Third Party Origination (TPO) sector is impressive. Starting from her early roles, Shannon quickly demonstrated her expertise. Her ability to solve complex problems and implement new strategies set her apart. She brought fresh ideas to the TPO industry, which led to significant improvements.

As Shannon’s reputation grew, she began to take on larger projects. She introduced innovative technologies that streamlined the loan and mortgage processes. Her work made these processes faster and more accurate. This shift improved the efficiency of many financial institutions.

Moreover, Shannon’s leadership skills became more evident. She guided her team with vision and clarity, leading to successful outcomes. Her approach combined deep knowledge of financial operations with a focus on customer satisfaction. This balance helped her stand out in a competitive field.

Shannon also focused on integrating new tools to enhance TPO practices. Her use of data analytics and automation transformed traditional methods. These advancements made the loan origination process smoother and more reliable.

In addition, Shannon’s ability to adapt to changing trends kept her at the forefront of the industry. Her strategies not only met current needs but also anticipated future demands. This foresight ensured that her contributions would have lasting effects on the TPO sector.

Overall, Shannon Swanick’s rise to prominence in TPO showcases her innovation and leadership. Her contributions have set new standards and significantly impacted the financial industry.

Innovative Strategies and Technologies

Shannon Swanick has introduced several innovative strategies and technologies in the Third Party Origination (TPO) sector. Her approach blends technology with traditional methods to improve efficiency and accuracy. One of her key innovations is the use of advanced data analytics. This technology helps assess borrower profiles quickly and accurately, speeding up the approval process.

Additionally, Shannon has championed the use of artificial intelligence (AI) in TPO practices. AI tools analyze large amounts of data to provide better insights into financial health. This means faster decision-making and fewer errors. By integrating AI, Shannon has made the loan origination process more reliable and efficient.

Another significant strategy is her focus on user-friendly interfaces. Shannon ensures that both clients and brokers can easily navigate TPO systems. Simple, intuitive interfaces reduce mistakes and make the process smoother for everyone involved.

Moreover, Shannon emphasizes the importance of real-time communication. Her solutions enable instant interactions between customers and financial institutions. This feature helps reduce wait times and increases transparency, leading to higher customer satisfaction.

Shannon also prioritizes security in her technological advancements. She implements robust encryption methods to protect sensitive data. Regular security audits are conducted to prevent breaches and ensure data safety.

In summary, Shannon Swanick’s innovative strategies and technologies have revolutionized TPO practices. Her use of data analytics, AI, user-friendly designs, and strong security measures has set new industry standards. These advancements not only improve efficiency but also enhance the overall experience for clients and financial institutions alike.

Client-Centric Approach and Impact

Shannon Swanick’s client-centric approach is a cornerstone of her success in the TPO industry. She believes that understanding each client’s unique needs is crucial for delivering exceptional service. Shannon’s focus on personalization means that every client receives tailored solutions designed specifically for them.

To achieve this, she utilizes advanced customer relationship management (CRM) systems. These systems help track client preferences and history, enabling more meaningful interactions. By having detailed insights into each client, Shannon can offer customized recommendations and support.

Shannon also prioritizes clear and effective communication. She has implemented tools that allow for real-time interactions between clients and financial institutions. This means clients can get answers quickly and stay informed throughout the process. Such transparency helps build trust and reduces any confusion.

The impact of Shannon’s client-centric approach is significant. Clients appreciate the personalized attention and efficient service, leading to higher satisfaction rates. Financial institutions benefit from improved client relationships and increased loyalty. This approach not only enhances the overall experience but also strengthens the reputation of the institutions she works with.

Additionally, Shannon’s commitment to understanding client needs fosters long-term relationships. Her methods have led to increased client retention and positive referrals. As a result, Shannon has set a new standard in how financial services should interact with their clients.

In summary, Shannon Swanick’s client-centric approach has made a profound impact on the TPO industry. Her focus on personalization, effective communication, and relationship-building enhances both client satisfaction and institutional success.

Challenges and Solutions

Shannon Swanick has faced several challenges in her career within the TPO industry. One major issue has been navigating the complex and ever-changing financial regulations. These regulations often create uncertainty and can slow down processes. To address this, Shannon stays updated on regulatory changes and invests in continuous education for herself and her team.

Another challenge is managing client expectations. Clients often have high demands and need quick responses. Shannon’s solution is to implement advanced technology that streamlines communication. By using real-time tracking and automated updates, she ensures clients are always informed and satisfied.

Shannon also deals with the challenge of competition. The TPO industry is crowded with many players. To stand out, she focuses on unique strategies and personalized service. This approach helps her build a strong reputation and gain trust.

Additionally, handling large volumes of transactions efficiently can be demanding. To overcome this, Shannon has introduced new software solutions that enhance process efficiency. These tools help her team manage tasks more effectively and reduce errors.

Lastly, maintaining high-quality service while scaling operations can be tough. Shannon addresses this by implementing robust training programs and standardizing best practices. This ensures that even as her business grows, the quality of service remains consistent.

In summary, Shannon Swanick has tackled various challenges through continuous learning, technology, and effective strategies. Her proactive solutions help her navigate obstacles and maintain excellence in the TPO industry.

Recognition and Achievements

Shannon Swanick’s dedication to the TPO industry has earned her widespread recognition. She has received numerous awards that highlight her leadership and innovative contributions. These accolades are a testament to her impact and expertise. Each award reflects her commitment to excellence and her ability to drive positive change in the financial sector.

In addition to awards, Shannon’s work has been featured in various industry publications. These features underscore her influence and solidify her reputation as a thought leader in TPO. Her insights are often sought after, and she is frequently invited to speak at industry events. This recognition from peers and experts alike emphasizes her standing in the field.

Furthermore, Shannon has played a pivotal role in mentoring upcoming professionals in the TPO industry. Her guidance has helped shape the careers of many, further expanding her legacy. This dedication to nurturing talent showcases her commitment not only to her success but also to the growth of the industry as a whole.

Finally, Shannon’s achievements extend beyond personal recognition. The innovations and strategies she has introduced have set new standards in the TPO industry. These contributions continue to influence how businesses operate, ensuring her lasting impact on the financial world.

The Future of TPO and Shannon Swanick’s Role

The future of the TPO industry looks promising, with ongoing advancements in technology and finance. Shannon Swanick is set to play a key role in this evolution. Her innovative mindset and deep understanding of the industry will guide her in shaping new trends. As the TPO landscape changes, Shannon’s expertise will help businesses adapt and thrive.

Moreover, her commitment to client satisfaction will continue to drive her success. By staying ahead of industry trends, Shannon will remain a leader in the TPO field. Her influence will not only impact her clients but also inspire future professionals. As the industry grows, Shannon Swanick’s contributions will ensure that TPO remains efficient, effective, and client-focused.

Conclusion

Shannon Swanick has undeniably made a significant impact on the TPO industry, blending innovation with a client-centric approach. Her dedication to enhancing financial processes and her ability to adapt to changing trends have set her apart as a leader. With a focus on technology, personalized service, and regulatory expertise, Shannon continues to shape the future of TPO. As the industry evolves, her influence will persist, ensuring that financial services remain efficient, effective, and customer-focused. Shannon Swanick’s contributions not only elevate her career but also pave the way for future advancements in the financial sector.